Advertising fraud is an existential risk to the ad tech industry. Programmatic advertising’s open ecosystem allows advertisers and publishers of any size to participate, but it also lets bad actors participate, polluting the quality of the sector as a whole.

How big an impact does ad fraud have? According to a 2016 report from The Association of National Advertisers (ANA) and WhiteOps, the loss from ad fraud was $7.2 billion in 2015—primarily from bots. To put that into perspective, total spend on display advertising, according to the 2015 report from the Interactive Advertising Bureau and PricewaterhouseCoopers, was only $12 billion, excluding Google and Facebook.

That means roughly 60 percent of all digital display ad budgets are lost to fraud.

Industry research pegs the impact quite high, but, to be fair, that simply looks at everything in aggregate. Based on data I’ve seen at my previous company, fraud varied greatly by ad exchange. Exchanges with poor reputations for quality had fraud in the 25–50 percent range, whereas reputable exchanges typically had less than 10 percent. (Keep in mind: All these measurements assumed the infallibility of detection tools, but we will get to that later.)

Most industry discussion around fraud, however, is only superficial and commonly conflates different issues under the broad label of “fraud.” For example, issues like viewability and brand safety are commonly thrown into the same overall bucket. Furthermore, many discussions explain fraud in terms that are too simplistic and fail to underscore the nuances of the issue.

In this extensive guide, you will learn what ad fraud is, the various forms it takes, why it exists, who is responsible for it, and how to protect yourself as a marketer from it. As always, we will lean on visuals wherever possible to help us wrap our heads around abstract concepts.

By the end, you will know more about ad fraud than 99 percent of people in ad tech.

To skip directly to a specific section of this guide, use the following links:

- Part 1: What Is Digital Ad Fraud?

- Part 2: Why Digital Ad Fraud Exists

- Part 3: Who Is Responsible For Digital Ad Fraud?

- Part 4: How To Protect Yourself Against Digital Ad Fraud

- Part 5: Final Thoughts

Estimated reading time: 27 minutes.

Let’s begin with the definition of fraud and the various ways it takes shape.

Part 1: What Is Digital Ad Fraud?

It’s surprising how much disagreement and confusion there is around defining ad fraud. One of the biggest misconceptions I see is a blanket definition of ad fraud as nonhuman (i.e., bot) traffic.

While that is certainly a characteristic of some forms of ad fraud, to make it the sole criterion for defining fraud is to miss the bigger picture: A significant percentage of fraud is actually of the human variety, as we will soon explore.

Another way of thinking about this logic is that while all bot traffic is indeed fraud, not all fraud is bot traffic—just like fire is indeed hot, but not all hot things are fire.

With that in mind, let’s look at a refined definition. Ad fraud has one or more of these characteristics:

- Nonhuman traffic (i.e., bots)

- Zero chance of being seen (i.e., zero percent viewability)

- Intentional misrepresentation

Most anti-fraud efforts—and most press coverage—seem to focus exclusively on nonhuman traffic. But fraud goes far beyond bots. It also includes ads that have zero chance of being seen by a human and ads that are intentionally misrepresented by fraudulent publishers.

Let’s look at each of these characteristics, starting with the nonhuman traffic.

Nonhuman Traffic

Nonhuman, or bot, traffic is used to generate fake impressions (pageviews) and fake clicks. In some cases, bad actors go so far as to generate fake form submissions and, therefore, fake conversions. Bots also come in a few different varieties.

Simple Bots

Simple bots are essentially scripts that run from a server somewhere, like Amazon Web Services. Because they are simple, they are usually easy to identify: they have a static IP, user agent, cookie ID, and so on. That makes fingerprinting and blocking them relatively easy.

A quick look at some demand-side platform (DSP) auction logs or even web server logs from those that click through will fairly easily reveal simple bots. Blocking them is easy, as well. For example, you could simply block all known data-center IPs.

Sophisticated Bots

Sophisticated bots, on the other hand, employ tactics like rotating user agents, using random proxies (to rotate IP addresses), mimicking normal click-through rates (CTRs), and in some cases even mimicking real mouse movements from captured browser activity. All of these factors make it harder to fingerprint and block them.

The screenshot above is a real-life example of what one of these bots would look like in operation from the fraudster’s perspective.

Botnets

Botnets are generally a large array of personal (residential) computers that have been compromised by bad actors. The actors have control of these machines, employing them for tasks like loading and clicking on ads, which generates legitimate-looking, but ultimately fake, impressions and clicks for advertisers.

Botnets are the hardest to detect and block, but they are also highly illegal and, therefore, riskier for bad actors to deploy. (To see a demonstration of how an infected computer behaves as a bot, check out this eye-opening video from Integral Ad Science.)

Nevertheless, since bots are programmable, they often exhibit patterns that make them detectable by experts. They also make for more enticing headlines, so they typically receive the lion’s share of media coverage.

Human Traffic

Human traffic is perhaps more sinister than nonhuman traffic because the end users are real while the generated impressions (and in some cases, clicks) are fraudulent. Vendors may have a harder time detecting this type of ad fraud when they only look for bots. The following are several different ways ad fraud can occur with human browsers.

Invisible Ads

Fraudulent publishers “hide” ads so that they fit the criterion of having “zero chance of being seen” by a human visitor in a couple of ways.

The first is referred to as “ad stacking” or “impression stacking,” which happens when an ad is hidden behind another ad. In such cases, the publisher generates multiple impressions for a single pageview, but only the top ad is visible.

In a similar vein, invisible iframes also intentionally hide ads. When ads are loaded in invisible (1 pixel by 1 pixel) iframes, one or more impressions with no chance of ever being seen are generated. Such tactics are relatively easy to detect using off-the-shelf ad verification tools like Integral Ad Science or Pixalate.

Arbitrage

One of the most underreported but insidious forms of human-based traffic fraud is a form of arbitrage. It can take many shapes and affect multiple formats, such as display and, most notably, video.

In essence, fraudulent publishers purchase traffic for a very low cost and resell it for a multiple of the price. For example, a publisher may sell its inventory for $5 CPM on average but may be purchasing questionable traffic to its site for a fraction of that cost.

Aside from the price inflation, arbitrage is fraudulent because it misrepresents the inventory being sold. If you buy ad space on Autotrader, you expect your ad to be seen by organic visitors, not people that have been brought to the site as a result of some shady traffic acquisition scheme.

Domain Spoofing

In the real-time bidding (RTB) ecosystem, publishers are sometimes allowed to declare their own domain and the label of their site ID.

Fraudulent publishers use this as an opportunity to misrepresent or spoof their inventory. They may identify themselves as huffingtonpost.com, but if you dig deeper, the actual domain the ad was served on was completely different. In other cases, the ad-serving domain is spoofed within the bid request.

Site Bundling

In the RTB ecosystem, inventory is classified by site ID and each site ID is supposed to correlate to a single domain.

But in practice, many publishers and ad exchanges bundle entire networks of domains under single site IDs. As a result, an advertiser might think they are buying efg.com but end up with ads served on xyz.com.

This configuration happens on the supply side of the ad tech ecosystem. I suspect this happens primarily out of convenience, but backroom deals and intentional misrepresentation can’t be ruled out. Ultimately, though, this type of fraud falls under the misrepresentation category, intentional or not.

Ad Injection

As a result of browser toolbars and other adware plugins, ads can be injected and/or replaced on any site, often without the user or publisher aware of what’s happening. This creates a situation where ad inventory might show up on ad exchanges as facebook.com, for example, but is not from Facebook’s actual ad inventory.

Facebook users who have never experienced ad injection could tell you that there are no 300×250 or 728×90 banner placements on the site. But when ad injection enters the picture, inventory can be created on premium websites out of thin air.

Cookie Stuffing

Cookie stuffing is nothing new, and there have been some high-profile cases where cookie stuffing was used to maximize affiliate revenue.

Cookies are still important today because they are the mechanism through which a large part of the ad tech ecosystem targets audiences. And with inexpensive sources of internet traffic available for purchase, cookie stuffing to dilute or misrepresent audience data is now a real thing.

It’s worth noting that cookie stuffing can occur on both human and nonhuman traffic, so technically it could fall into either major category—and sometimes both.

Click Farms

Incentivized programs, often masked as “work from home” or “make money online” schemes, pay real people to click on ads and even fill out forms, resulting in valueless impressions, clicks, and conversions.

Since real people are clicking, most software vendors struggle to catch these schemes, but they are most definitely fraudulent activity. (Check out this video to enjoy a good parody of what these schemes look like.)

Part 2: Why Digital Ad Fraud Exists

Now that we have covered what ad fraud is, the magnitude of the problem, and the many ways in which it takes shape, it’s time to examine one of the biggest questions around the topic of ad fraud: Why does it exist in the first place?

Several factors contribute to an environment that makes the problem possible and persistent:

- The open nature of the programmatic advertising marketplace

- The fact that ad fraud is technically not illegal

- Misaligned incentives across the entire supply chain, leading to inertia and passive treatment of the problem

The Downside Of Open Marketplaces

The programmatic advertising ecosystem is an open marketplace, allowing any advertiser or publisher to participate.

It’s a democratizing concept, but it also creates an opportunity for bad actors to pollute it with not only poor quality but, in some cases, outright deception as well. It’s the double-edged sword of open ecosystems.

Because the barrier of entry for new players is so low, anyone can sell and anyone can buy. This is a good thing for smaller advertisers, agencies, and publishers—but it’s also good for bad actors.

The alternative is the closed platform, or “walled garden,” such as Google, Facebook, LinkedIn, and Twitter. Closed platforms come with their own trade-offs, however: They offer decreased competition and transparency and, therefore, decreased innovation and accountability. This leads to fewer choices for marketers and platforms that “mark their own homework,” which are never good things.

Ad Fraud Is Not Illegal

One of the biggest reasons fraud is so rampant is simply that it’s not illegal. Unlike credit card fraud, nobody is going to jail for ad fraud, and it’s not exactly the sort of activity that elicits a crackdown from law enforcement, which means there is significantly less risk involved. And yet it’s extremely lucrative.

Imagine a bad actor is weighing their options. On one hand there is credit card fraud, which has modest rewards and very high risks. On the other is ad fraud, which is very lucrative and very low risk. It’s a no-brainer.

Something else to keep in mind is that the higher the payoffs, the higher the amount of fraud.

Case in point: video ads. According to the same ANA/White Ops fraud study mentioned earlier, video has roughly twice as much fraud as desktop display does. This makes sense when you consider that video CPMs average at about $9, while traditional display is more in the $1 to $2 range.

Now, I’m not trying to encourage or endorse this kind of behavior. The point I’m trying to drive home is that because it’s easy money, it almost always results in people pushing the limits in an ultimate race to the bottom.

Lack Of Proper Incentives

Despite the allure of programmatic advertising, it’s increasingly difficult to argue with the idea that it’s a dead end: it wouldn’t be the first technology (or company) that made sense on paper but failed because of the lack of proper incentives for those involved.—Ben Thompson, author and founder, Stratechery

While I agree with Thompson about the incentives issue, I’m not sure that programmatic is a dead end, because incentives can change. The excerpt above refers to the fact that in programmatic advertising and ad tech in general, almost everyone makes their money on volume and transactions.

In other words, the age-old CPM pricing model rewards volume. And the business model for most vendors in the ad tech space is based on a percentage of the ad spend. This applies almost across the board: agencies, DSPs, supply-side platforms (SSPs), you name it. They all use this as the predominant business model.

Ad tech players and even agencies make just as much revenue from fraudulent impressions as from legitimate ones. As a result, there is no urgency to fight against fraud. It’s only when advertisers and marketers start demanding action that vendors do anything.

Yet these poor incentives affect publishers in the long run, as well. The CPM pricing model incentivizes pageview-driven publishing practices: multi-page slideshows, auto-refresh ads, click-bait journalism, regurgitated reporting, and so on. These practices degrade the user experience.

The incentive for volume also opens the doors to a tremendous amount of ad fraud, whether it’s nonhuman traffic or low-cost arbitraged human traffic. This questionable traffic acquisition deteriorates the quality of the ad tech ecosystem.

As a result, many publishers pursue scale by any means necessary, even when it hurts users and advertisers and, ultimately, themselves.

The Victims Of Ad Fraud

It’s pretty obvious that the advertisers and marketers are the primary victims here. Everyone else benefits, even if such benefits are ultimately short-lived.

Ad fraud simply doesn’t perform for advertisers. Yet it’s detrimental to everyone’s business model over time, including agencies, ad tech companies, and even publishers, because media that doesn’t perform will inevitably lead to retention issues.

But there is another victim that has only recently come into focus through the larger ad-blocking debate: internet users.

Internet users suffer from all of these improper incentives mainly in the form of poor user experience: slow-loading websites, click-bait journalism, fake news, excessive behavioral tracking, botnet and malware proliferation, and so on. And they’ve decided to take measures into their own hands with ad blockers.

If the situation doesn’t improve, the final victim of ad fraud will be the ad tech industry itself.

But who should stop ad fraud?

Part 3: Who Is Responsible For Digital Ad Fraud?

To determine who should be responsible for stopping ad fraud, we have to look closer at the participants in the supply chain.

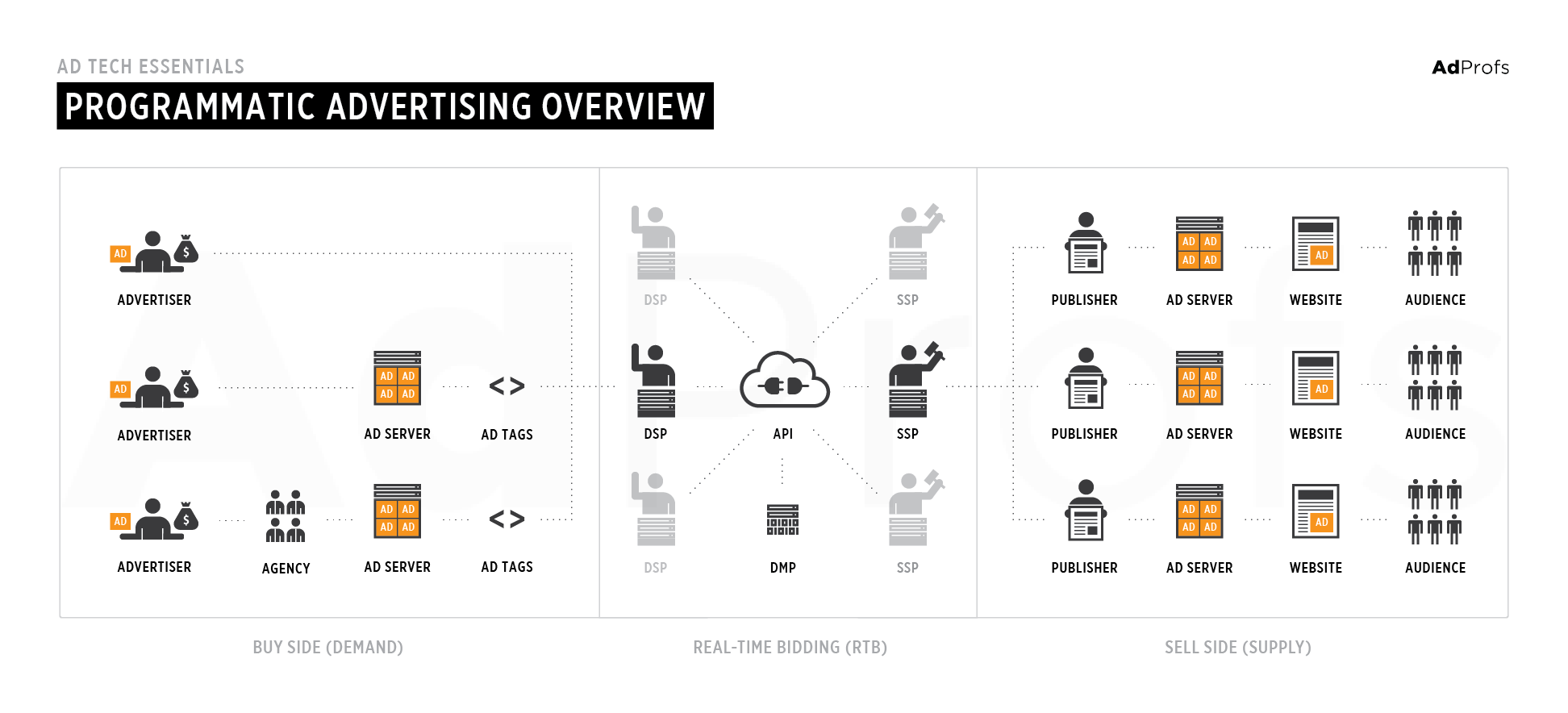

The programmatic ad ecosystem is very compartmentalized. There are sell-side technologies and buy-side technologies, each serving their own constituents. Most individual players have been reluctant to even discuss ad fraud’s existence for fear of opening Pandora’s box.

But ad fraud impacts all participants, and it is in everyone’s long-term interest that it be stamped out. It’s time for the players to own their portion of responsibility.

The current “solution” is that each participant pressures the participant one step upstream from it. A brand demands clean inventory from its agency. The agency expects its DSP partners to have clean inventory. The DSPs demand that ad exchanges do a better job of passing through clean inventory. And so on.

In some ways it resembles the diffusion of responsibility phenomenon where everyone thinks someone else will intervene. Furthermore, it does little to root out the problem. Instead, we must look at how fraud enters the ad tech ecosystem and see how responsibility flows.

The Role Of Publishers

Fake traffic has become a commodity. There’s malware for generating it and brokers who sell it. Some companies pay for it intentionally, some accidentally, and some prefer not to ask where their traffic comes from.—Ben Elgin, Michael Riley, David Kocieniewski, and Joshua Brustein, “How Much of Your Audience Is Fake?” (Bloomberg BusinessWeek)

Publishers are ground zero for fraud, and, as the quote above suggests, publishers have different levels of intent and complicity.

Some engage in fraudulent traffic acquisition intentionally; others do so accidentally—usually under the auspices of “audience development.”

Whatever the reason, fraud exists, and publishers must be accountable for any fraudulent impressions found in their inventory.

Prudent publishers should proactively monitor their own inventory using one or more of the many tools available, such as Moat or Integral Ad Science. This allows them to ensure they aren’t unintentional vehicles for fraud and signals to the other participants that their inventory is clean.

The Role Of Supply-Side Platforms

It is difficult to get a man to understand something, when his salary depends upon his not understanding it. —Upton Sinclair

Things get a little tricky with the ad tech players, so bear with me as I explain.

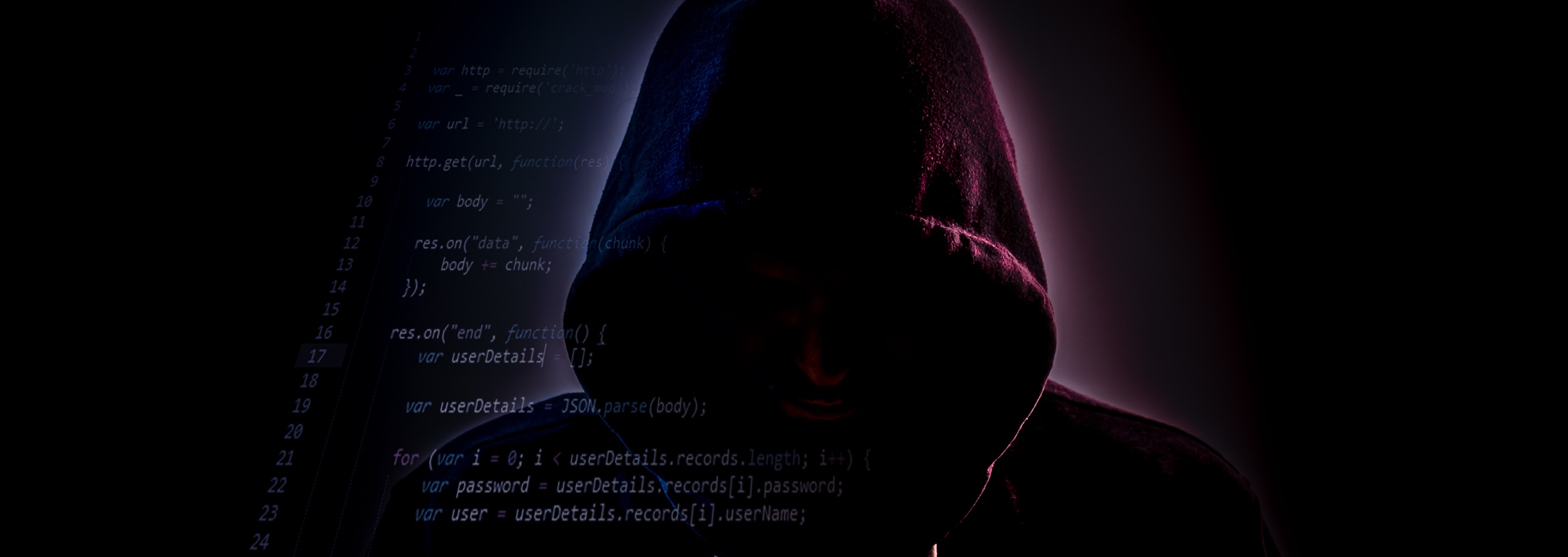

Back in the day, we had only ad networks. Ad networks work with both publishers and advertisers, manually vetting each participant in the ad network. They are accountable to both the supply and the demand sides.

(Click image to enlarge)

In the programmatic ad tech ecosystem, publishers (the supply side) are separated from advertisers (the demand side) by technology. Publishers use SSPs as their agents to sell their inventory, while advertisers use DSPs as their agents to buy that inventory.

(Click image to enlarge)

In determining where fraud enters the ecosystem, we move down the supply chain from publishers, starting with the SSPs.

This is a crucial point to understand: Fraudulent publishers cannot take part in the programmatic ecosystem without an SSP enabling them with the technology to participate.

This raises an obvious question: Why would an SSP allow fraudulent inventory on its platform?

There are a few possible answers:

- The SSP doesn’t question its publishers’ upstream traffic sources. In other words, it plays ignorant by taking a hands-off approach with its customers. This goes back to those misaligned incentives.

- The SSP knows about the practice but turns a blind eye to it. This, too, goes back to misaligned incentives.

- The SSP simply doesn’t know. Fraudsters will go to great lengths to hide their tracks, including bundling their fraudulent sites with legitimate sites (essentially using them as Trojan horses).

None of these scenarios are acceptable. While an SSP is an agent to the sell side and identifying fraud can be difficult, it nonetheless owes a duty to the customers who purchase its goods.

We must enforce higher standards on the supply side. They are the first line of defense against fraud, so they bear the most responsibility.

The Role Of Demand-Side Platforms

If fraudulent impressions are proliferating through exchanges, the responsibility to combat fraud necessarily falls on DSPs. While many are up to the challenge, the reality is it’s a never-ending game of whack-a-mole.

There are literally hundreds of thousands of sites that come through the exchanges. Checking them all by hand is virtually impossible.

Even if it were possible with a massive team, it would negate the efficiency gains of using programmatic advertising in the first place. On top of that, SSPs are generally protective of their relationships with publishers (rightly so), making it difficult for DSPs to get information or ask questions directly of publishers.

That said, there are measures DSPs can take. At my previous company, our DSP used a combination of human checks and technical measures to monitor and block fraud on our platform.

In addition, all our DSP traffic was monitored using third-party fraud-detection technology. This produced rich reporting on questionable traffic that we blocked from future campaigns.

Our team routinely reviewed this data and blocked sources with excessive nonhuman traffic. (We used other tools and processes as well, but I don’t want tip off fraudsters.)

Unfortunately, not all DSPs go to these lengths to fight fraud, which passes the problem along to marketers. And without the support of all of its SSP partners, marketers will have a Herculean task fighting fraud.

Ultimately, everyone has to do their part: publishers, SSPs, DSPs, agencies, and marketers. But if everyone else does their job to tackle fraud, marketers should have little to do.

In An Ideal World

In an ideal world, fraudulent inventory would never make its way into the marketplace because each participant would do their part and act as a necessary check on fraud. This would entail:

- Publishers ensuring that ads are served to real humans by monitoring traffic sources

- Suppliers, such as ad exchanges or SSPs, vetting all publishers on their platforms

- Ad-buying platforms (DSPs) proactively monitoring and blocking low-quality inventory

- Marketers utilizing their own tools and practices as a last line of defense

Unfortunately, we don’t live in a perfect world, and not all participants are carrying their respective load. It is incumbent on marketers, then, to protect themselves against fraud.

Part 4: How To Protect Yourself Against Ad Fraud

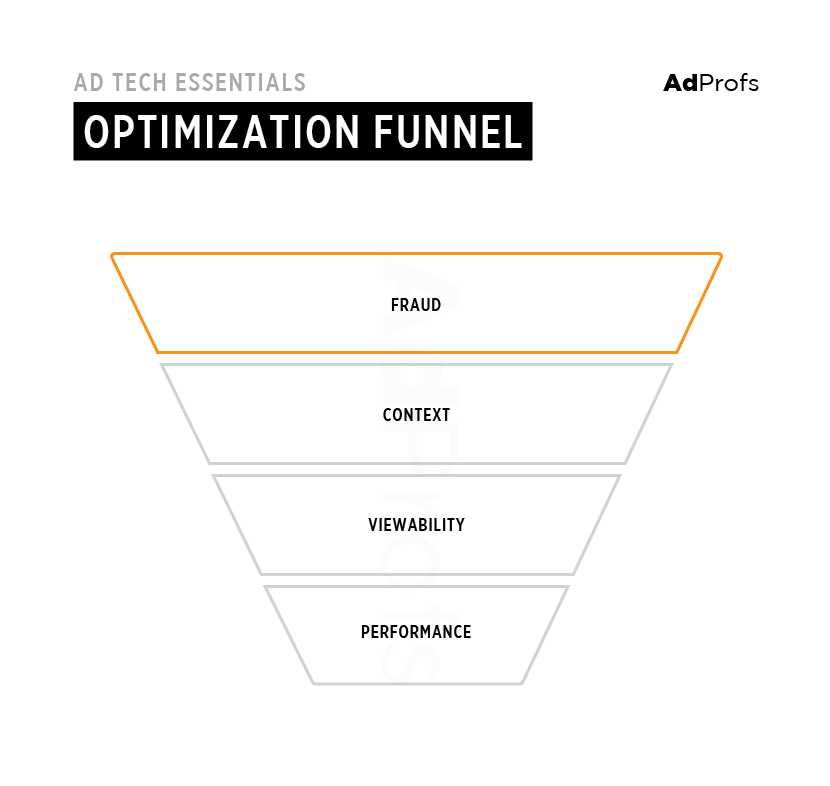

As we’ve seen from the previous section, learning how to protect yourself against ad fraud is crucial. When optimizing ad campaigns, you must address fraud first before trying to optimize for viewability or brand safety. If left unchecked, fraud essentially poisons everything else. After all, context and viewability are irrelevant if the ads are not viewed by human beings.

(Click image to enlarge)

Due to the nature of programmatic advertising, there are thousands of long-tail websites in the ecosystem, and the vast majority of fraud originates from them. You can avoid a lot of ad fraud, therefore, by taking a publisher-centric approach to campaigns, handpicking website placements, whether they be through private marketplace deals or direct buys.

Yet audience-based campaigns (like retargeting) are a core part of many marketers’ strategy. In such cases, extra vigilance is important. The following steps will help you take evasive action and mitigate the impact of fraud.

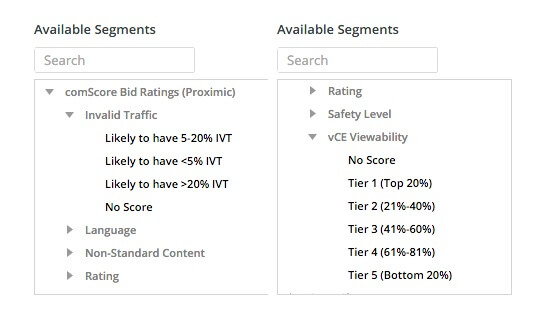

Step 1: Use pre-bid contextual data segments

Leveraging contextual brand safety segments is the easiest way to protect yourself during ad buys. These contextual targeting (really, exclusion) segments should be available through your DSP. The data comes from providers like comScore and Integral Ad Science.

The great part about these segments is that they are pre-bid. This means you avoid the fraud altogether, at the outset, instead of reacting and filtering it out after you’ve bought the impressions. The cost of these contextual segments can be anywhere from $0.02 to $0.20 CPM.

Using comScore Bid Ratings as an example, you can select segments that let you target inventory with specific levels of invalid traffic. You also can select segments for targeting inventory at certain viewability tiers, ensuring that your campaigns not only avoid fraud but also get seen.

Keep in mind the stricter you are with these targeting segments, the more constrained your potential pool of inventory. If delivery is a top priority, you might run into scaling issues. In that case, you may need to relax your tolerance level somewhat.

Step 2: Use an ad verification vendor

Ad verification vendors, such as Integral Ad Science, DoubleVerify, Moat, and Pixalate, provide campaign metrics for advertisers, including viewability, invalid traffic, and more. The cost of these tools is usually a flat rate in the range of $0.01 to $0.07 CPM for post-bid measurement.

Using an ad verification vendor requires that you, as the media buyer, at least have your own ad server, so you can include the vendor’s tracking code in your ad tags. That’s how you put these vendors in place to measure your campaigns.

If you have the resources, I suggest working with multiple vendors. That will give you the ability to consistently evaluate, compare, and validate their data against each other.

Keep in mind, however, that working with an ad verification vendor is not a panacea for fraud. When used correctly, these tools offer additional data to help mitigate fraud’s impact. But they can also degrade into mere props that some might use to signal diligence or to defer accountability. Furthermore, these tools are not infallible. Fraudsters are constantly figuring out how to evade detection from each vendor, which is why ad verification tools cannot be trusted as the ultimate arbiters of truth.

Step 3: Analyze your campaign data

Once you have data coming in from your verification vendors, start auditing your campaigns for signs of fraud immediately. You’ll receive metrics like viewability and invalid (or suspicious) traffic levels. Use this information to optimize your campaigns by shutting down low-quality publishers and placements. You can then reallocate your budget to higher-quality sites.

Auditing your campaigns without verification vendors is not as systematic or scalable but still possible—even encouraged. When looking through your campaign data, look for suspicious publishers and investigate them. This type of manual analysis can be time consuming and unrealistic to perform at scale for hundreds and thousands of sites. However, it can still be valuable to sample random publishers for analysis. (For automated methods of evaluating publishers, tools like Trust Metrics can automatically evaluate publishers based on a long list of criteria.)

You also may want to look for unusual spikes in proxy metrics like CTR. Oftentimes, a CTR above 1 percent is suspicious, especially in an industry where the average is below 0.1 percent.

Whether you audit your campaigns with or without a verification vendor, you must be vigilant about monitoring for fraud. Like I said above, the fight against fraud is a game of whack-a-mole. Despite SSPs’ and DSPs’ efforts, it’s prudent not to rely on them. Active monitoring is especially important in the open exchanges, where the barriers are lowest.

Step 4: Maintain a universal blacklist

A common media-buyer practice is to use domain whitelists and blacklists. Whitelists are lists of domains that you want to explicitly target. They ensure that your ads don’t get served elsewhere, which tends to happen with bundled sites. Whitelisting isn’t perfect, but it’s a best practice if you are trying to target specific publishers. It’s usually a core function within most DSPs, so consider it a free tool at your disposal. (Tools like Trust Metrics are also handy for building custom whitelists.)

Blacklists, as you might have guessed, have the opposite function. An actively managed blacklist is a good way to block low-quality sites from your campaigns. The audits in Step 3 will tell you what domains to blacklist. (Some DSPs, like The Trade Desk, offer a standard blacklist of low-quality sites you can use for convenience.)

The downside to managing whitelists and blacklists is that it’s a reactive, manual process. Nor is it perfect, since some bad actors can spoof their impressions to evade such tactics. Regardless, you should still use them—especially since they provide a competitive advantage against other, less-diligent advertisers.

Step 5: Consider private marketplaces deals

Private marketplaces are “privileged” auction environments. They take place at a higher ad-serving priority than the open, public marketplace. You’ll sometimes hear a private marketplace referred to as a “deal ID,” which is the technical term for the mechanism that powers it.

Most fraudulent publishers don’t have private marketplaces, for obvious reasons, such as not having sales or ad ops teams to support such deals. This makes participating in private marketplaces generally a safer option for marketers.

One downside to private marketplaces, however, is that they limit scale, which is a main benefit of programmatic buying. If you run a retargeting campaign, for example, you want to find your audience wherever they happen to be online. But if you limit your buying to a handful of sites, you naturally limit your reach. So that’s a potential tradeoff.

Bonus Tips For Dealing With Ad Fraud

In addition to the best practices we just covered, here are some more tips to help you deal with fraud:

- Avoid easy-to-fake campaign goals like impressions and clicks. Those are merely proxy metrics for actual business outcomes, like signups, sales, and subscriptions. Focus instead on actual business metrics. If you use any sort of auto-optimization algorithm in your DSP, avoid click-based goals. Instead, go for more concrete goals, like conversions. It’s too easy for algorithms to get tricked by placements affected by click bots.

- Embrace a defensive buying mindset. Being defensive means not trusting open or unmonitored inventory. It essentially means being a little paranoid. For example, avoid unmonitored open exchange inventory altogether, instead pursuing more reputable publishers, like those with private marketplaces. Another way to be defensive is to avoid publishers with non-transparent inventory or those that bundle multiple sites together.

- Refuse to pay for fraudulent impressions by blocking payment for fraud. No marketer should have to pay for fraudulent impressions, period. By taking a zero-tolerance approach to ad fraud, you, as a marketer, send a message to vendors that it’s unacceptable. And if it continues, you have to eventually ask yourself if it makes sense to continue fighting. Without your DSP’s support, it might make more sense to explore other partners or channels.

Part 5: Final Thoughts

Whether you are a marketer, agency, publisher, or ad tech platform, digital ad fraud is a critical subject to understand. If you made it this far, congratulations—you now know more about ad fraud than 99 percent of digital advertising professionals.

You now understand that:

- Ad fraud is a significant problem in the ad tech ecosystem.

- The various types of ad fraud include both human and nonhuman traffic.

- Fraud exists because it’s lucrative and it’s low risk because it’s not illegal.

- Fraud is enabled by our open ecosystem and misaligned incentives.

- Fraud will undermine the whole industry if left unaddressed.

- Stopping ad fraud requires vigilance from all supply chain participants.

- Shared responsibility leads to the diffusion of responsibility problem.

- It’s incumbent on marketers to take evasive action to avoid fraud.

- Ad fraud is the first issue to address when optimizing campaigns.

- There are concrete, actionable tactics for avoiding ad fraud.

Let me stress the importance of addressing ad fraud as an industry:

Digital advertising is a zero-sum game. Fraudsters are taking a significant share of advertising budgets. And they are stealing that share from legitimate publishers—publishers doing real work and incurring real expenses.

By essentially manufacturing page views using bots and other schemes, fraudsters expand inventory supply to a point where CPM rates are forced downwards. This creates a false expectation from marketers that cheap inventory is available and commonplace. And because of this extraneous inventory, all the struggling publishers—who employ real journalists for real money—are receiving an even smaller share of the advertiser’s wallet. This is why fraud is an awful disease that must be eliminated.

Eliminating fraud would solve two pivotal challenges in digital advertising.

For marketers, it would improve advertising campaign performance, which would result in increased investment and growth in digital channels. For publishers, it would put much-needed revenue back into their pockets, which would enable the creation of better content and, more importantly, support their businesses.

The only losers would be the ad tech companies that survive on the transaction of fraudulent inventory and, of course, the fraudsters themselves, who are currently siphoning billions of dollars from the ad industry with impunity.

Not a bad outcome if you ask me. It’s just a matter of time and will.

~

If you like these kinds of guides, you can subscribe via email to get notified whenever a new one is published.

Last updated: May 17, 2017